PRODUCING IN FRANCE / PRODUCING WITH FRANCE

You are currently working on an exciting project and there is something French in the script: a key location, a city, a region, a character (fictional or real). Or you know that your director or one of your stars has a large following in France and you want to benefit from this notoriety. Maybe you’re developing an ambitious animated film, or a film that requires impressive special effects, so you’d like to work with some of France’s most creative studios. In any case, you feel that you should partner with someone in France and figure out how to raise money from the French market. You can access the brand new TRIP (Tax Rebate for International Production) and save 30 % of your French expenditures.

Otherwise you can explore the CNC’s traditional system and set up a co-production with a French partner, which will label your project a “French qualified film” and may allow it to benefit from the available grants or incentives, the Sofica investments, regional supports, etc. This pretty much depends on each individual project.

Since 2009, France has established a Tax Rebate for International Production that reimburses 30% of the eligible costs of foreign movies and TV productions shot in France, as long as they comply with a set of requirements. This refundable incentive that can reach up to €30 million, and is also open to animation and VFX projects made, partly or completely, by a French studio.

Tax Rebate For International Production

T.R.I.P.

What is the TRIP?

This advantage concerns projects wholly or partly made in France and initiated by a non-French company. The TRIP is selectively granted by the CNC – French National Center for Cinema, TV and the moving image to the French Production services company.

The TRIP amounts up to 30% of the qualifying expenditures incurred in France, and can total a maximum of €30 million per project. The projects have to include elements related to the French or European culture, heritage, and territory.

WHO CAN QUALIFY THE TRIP?

To be able to file a TRIP application, a company must act as provider of production services for sequences filmed or produced in France.

This company must be subject to corporate income tax in France, and will be defined as “the company in charge" (in compliance of the contract with a non- French production company) of both supplying, the artistic and technical means, for making the cinematographic or audiovisual production, and monitoring its achievement on the other.

WHAT CONDITIONS APPLIES TO QUALIFY THE TRIP?

TO BE ELIGIBLE, THE PROJECT MUST SCORE A MINIMUM OF 18 POINTS IN TOTAL, INCLUDING AT LEAST 7 POINTS IN THE "DRAMATIC CONTENT" BLOCK.

- It must be a fictional cinematographic or audiovisual project of live action.

- 15% of the shots, or on average one and a half shots per minute, are digitally processed to add characters, decorative elements or objects involved in the storyline, or to modify the rendering of the scene or the camera’s point of view.

- The project must not receive any French State traditional financial support. Thus official co-productions with France do not qualify.

- It must not be pornographic or promote violence.

- It must have a minimum spending of €250000 of qualifying expenditures in France or incur at least 50% of the production budget, when the world budget is below €500000.

- For live action, production must shoot at least 5 days in France.

- Have a minimum of points to the cultural grading scale, classified into 3 main part

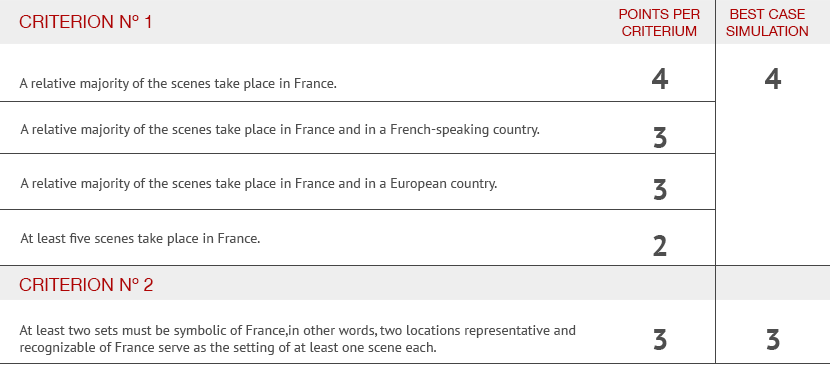

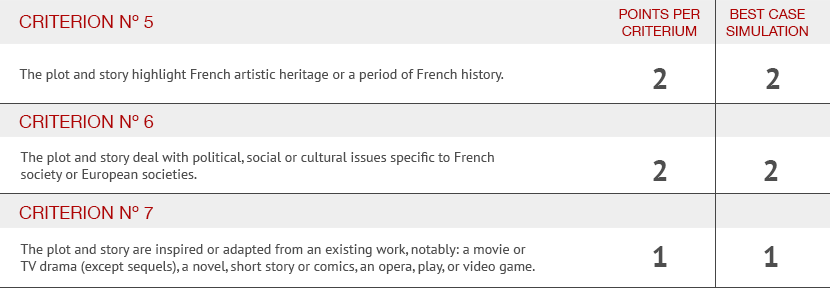

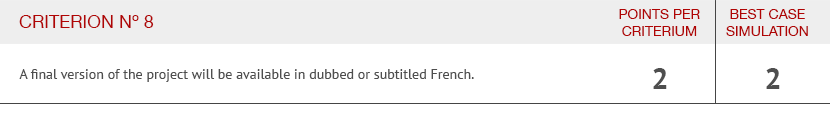

CRITERION OF SELECTION

To be eligible, the project must score a minimum of 18 points in total,

including at least 7 points in the "Dramatical content" block.

It is possible to choose only one option per criterion.

1. PROJECT SPECIFICITIES

MAXIMUM TOTAL: 18 POINTS

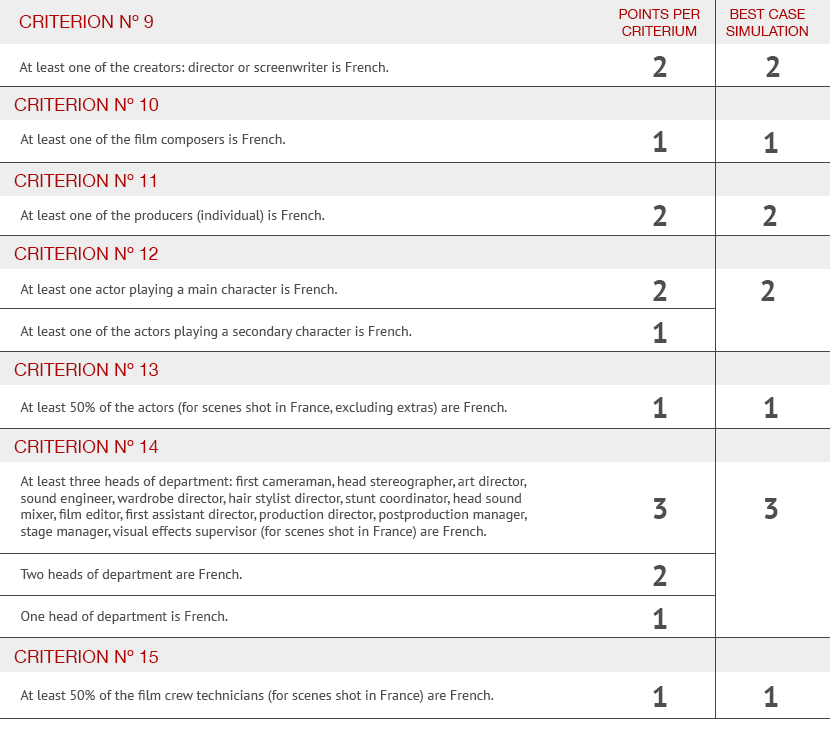

2. NATIONALITY OF CREATORS AND CREATIVE COLLABORATORS

MAXIMUM TOTAL: 12 POINTS

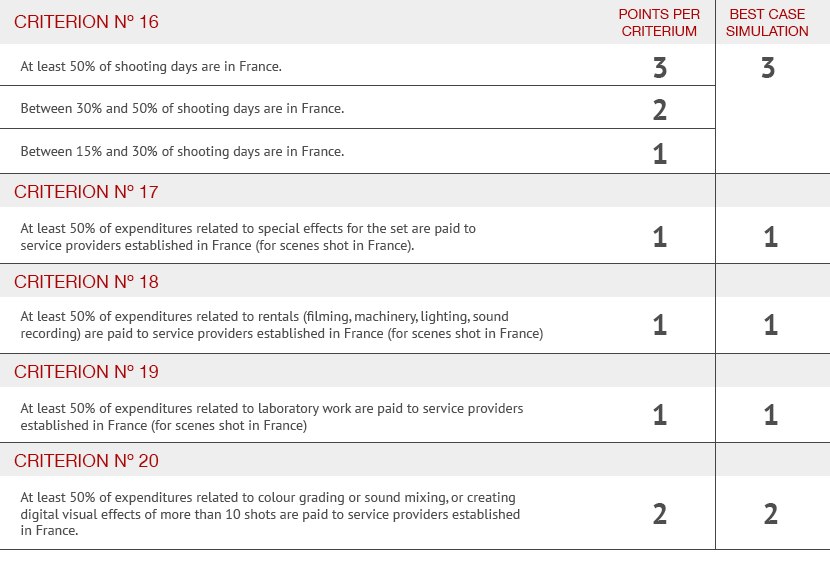

3. PRODUCTION INFRASTUCTURE

MAXIMUM TOTAL: 8 POINTS

WHAT ARE THE STEPS AND PROCEDURES?

WHAT ARE THE QUALIFYING EXPENDITURES

To be eligible, expenditures mentioned hereafter must be incurred in France by the PSC who has submitted the TRIP application for the project. These expenditures must directly contribute to the production needs. The maximum tax rebate is €30 million per project. It amounts to 30% of the following pre-tax expenditures:

DEFINITIONS, ELIGIBLE COUNTRIES AND TERRITORIES

You want to make an official Co-Production ?

Desiring to strengthen the relationship France and India concerning film production, since 1985, both governments of the French republic and the Republic of India has agreed to the Indo-France treaty.

The official agreement between the government of the French Republic and the Government in India was signed on december, 6th, 2010.

Updated from the 1985\'s version:

Co-production Agreement between France and India in 1985