PRODUCING IN FRANCE / PRODUCING WITH FRANCE

You are currently working on an exciting project and there is something French in the script: a key location, a city, a region, a character (fictional or real). Or you know that your director or one of your stars has a large following in France and you want to benefit from this notoriety. Maybe you’re developing an ambitious animated film, or a film that requires impressive special effects, so you’d like to work with some of France’s most creative studios. In any case, you feel that you should partner with someone in France and figure out how to raise money from the French market. You can access the brand new TRIP (Tax Rebate for International Production) and save 30 % of your French expenditures.

Otherwise you can explore the CNC’s traditional system and set up a co-production with a French partner, which will label your project a “French qualified film” and may allow it to benefit from the available grants or incentives, the Sofica investments, regional supports, etc. This pretty much depends on each individual project.

Since 2009, France has established a Tax Rebate for International Production that reimburses 30% of the eligible costs of foreign movies and TV productions shot in France, as long as they comply with a set of requirements. This refundable incentive that can reach up to €30 million, and is also open to animation and VFX projects made, partly or completely, by a French studio.

Tax Rebate For International Production

T.R.I.P.

What is the TRIP?

This advantage concerns projects wholly or partly made in France and initiated by a non-French company. The TRIP is selectively granted by the CNC – French National Center for Cinema, TV and the moving image to the French Production services company.

The TRIP amounts up to 30% of the qualifying expenditures incurred in France, and can total a maximum of €30 million per project. The projects have to include elements related to the French or European culture, heritage, and territory.

WHO CAN QUALIFY THE TRIP?

To be able to file a TRIP application, a company must act as provider of production services for sequences filmed or produced in France.

This company must be subject to corporate income tax in France, and will be defined as “the company in charge" (in compliance of the contract with a non- French production company) of both supplying, the artistic and technical means, for making the cinematographic or audiovisual production, and monitoring its achievement on the other.

WHAT CONDITIONS APPLIES TO QUALIFY THE TRIP?

TO BE ELIGIBLE, THE PROJECT MUST SCORE A MINIMUM OF 18 POINTS IN TOTAL, INCLUDING AT LEAST 7 POINTS IN THE "DRAMATIC CONTENT" BLOCK.

- It must be a fictional cinematographic or audiovisual project of live action.

- 15% of the shots, or on average one and a half shots per minute, are digitally processed to add characters, decorative elements or objects involved in the storyline, or to modify the rendering of the scene or the camera’s point of view.

- The project must not receive any French State traditional financial support. Thus official co-productions with France do not qualify.

- It must not be pornographic or promote violence.

- It must have a minimum spending of €250000 of qualifying expenditures in France or incur at least 50% of the production budget, when the world budget is below €500000.

- For live action, production must shoot at least 5 days in France.

- Have a minimum of points to the cultural grading scale, classified into 3 main part

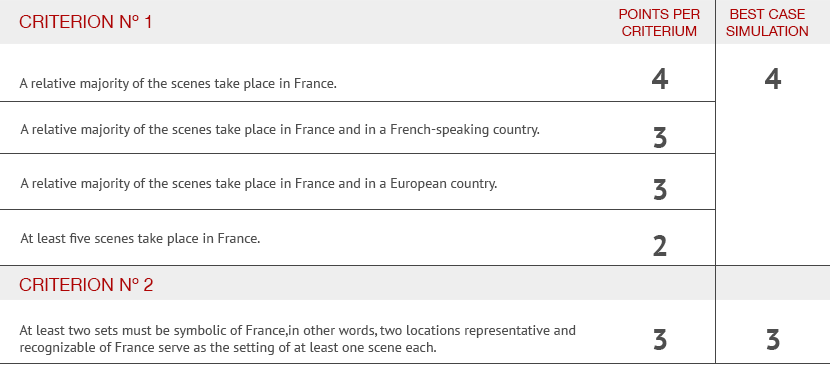

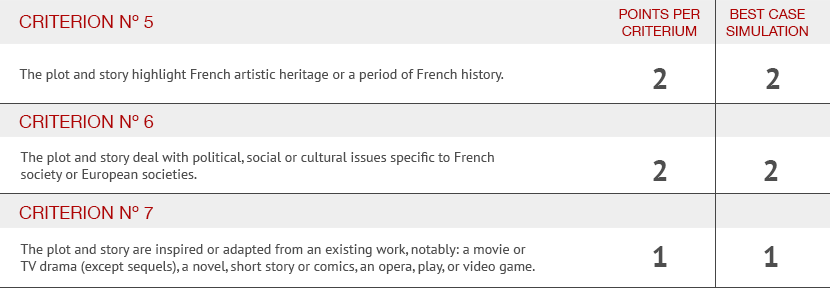

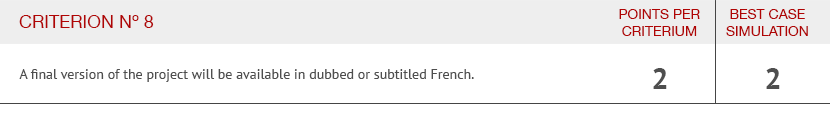

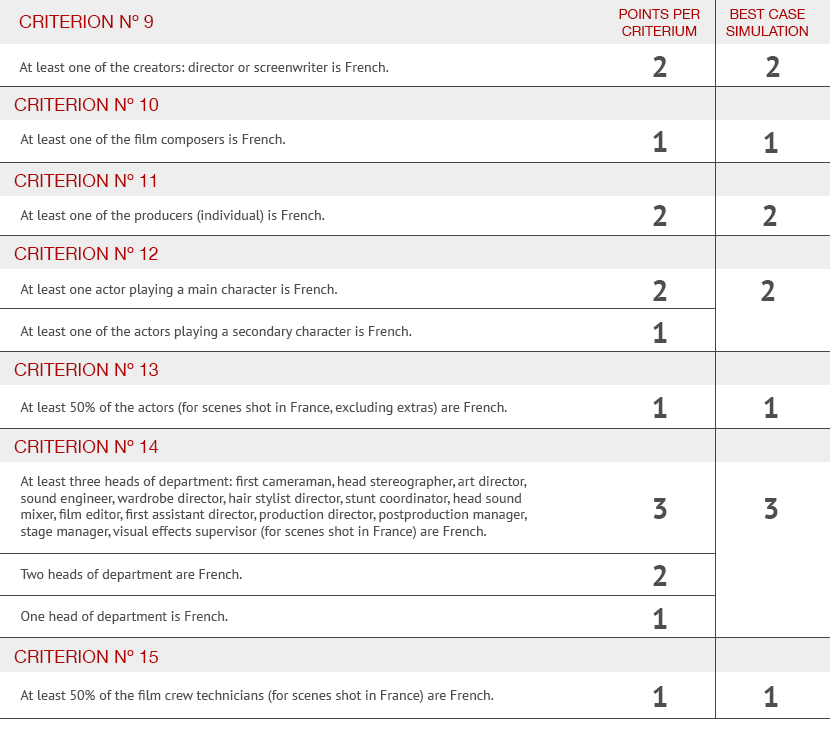

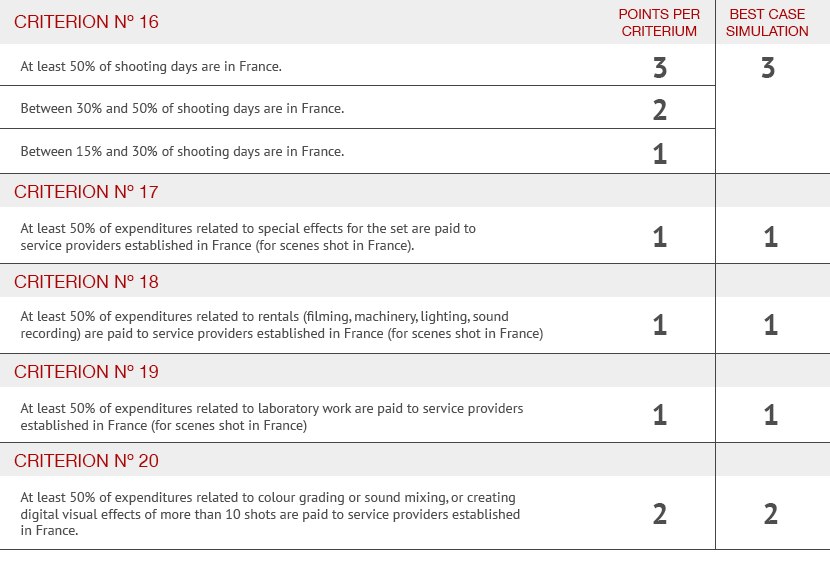

CRITERION OF SELECTION

To be eligible, the project must score a minimum of 18 points in total,

including at least 7 points in the "Dramatical content" block.

It is possible to choose only one option per criterion.

1. PROJECT SPECIFICITIES

MAXIMUM TOTAL: 18 POINTS

2. NATIONALITY OF CREATORS AND CREATIVE COLLABORATORS

MAXIMUM TOTAL: 12 POINTS

3. PRODUCTION INFRASTUCTURE

MAXIMUM TOTAL: 8 POINTS

WHAT ARE THE STEPS AND PROCEDURES?

PROVISIONAL QUALIFICATION

The French PSC files a provisional qualification at the CNC, with the necessary supporting documents. The standard application file is available on the CNC website: www.cnc.fr. The application cannot be submitted until at least a preliminary Production service agreement (PSA) has been signed.

Indeed, this contract is one of the mandatory documents for applying.

Qualifying expenditures start the date of reception of the application by the CNC. No spending incurred before this date will be taken into account for the TRIP. The CNC, following Film France’s assessment, will decide whether the project is eligible based only on the criteria defined above. The applicant is then granted a provisional qualification.

FINAL QUALIFICATION

Maximum 24 months after the last French spend the French PSC submits a final qualification application to the CNC, along with the mandatory documents, including a DVD.

The CNC then verifies that the production still complies with the qualifying criteria, in which case a final qualification is issued.

COLLECTING THE INTERNATIONAL TAX REBATE

The tax authorities may pay the tax rebate before the final qualification application has been submitted. However, it is the final qualification that officially confirms the right to this tax rebate. Should the final qualification be refused, the tax authorities would demand the tax rebate to be reimbursed. At the end of each fiscal year, a statutory auditor must certify the yearly production accounts, which, along with the provisional qualification and the income tax return, is sent by the French PSC to the tax authorities.

A refund is issued by the French State to the extent the production tax credit exceeds the company’s tax liability.

The TRIP is exempt of tax and VAT exempt.

T.R.I.P. CASH FLOW

Even though the TRIP is a non-transferable debt of the State to the French PSC, as soon as provisional qualification has been obtained, banks are legally allowed to monetize this refundable tax credit so that the production company can get the money earlier.

CREDITS

Any production that received the TRIP must mention as follows in the beginning or ending credits, either in French or in the original language of the production: “Cette oeuvre a bénéficié du crédit d’impôt en faveur de la production de films étrangers en France”, This film benefited from the French Tax Rebate for International Production.”

WHAT ARE THE QUALIFYING EXPENDITURES

To be eligible, expenditures mentioned hereafter must be incurred in France by the PSC who has submitted the TRIP application for the project. These expenditures must directly contribute to the production needs. The maximum tax rebate is €30 million per project. It amounts to 30% of the following pre-tax expenditures:

SALARIES AND WAGES OF WRITERS AND ACTORS

· wages paid to French or EU writers (advances on earnings) and related social contributions, under French contract

· wages paid to French or European actors, including extras and artists responsible for the dubbing, commentary, voice-overs, post-synchronization, recording of the soundtrack, and the related social contributions.

Note that the payments considered for the tax rebate are capped at the minimum wages set in the French movie or TV collective bargaining agreements.

SALARIES PAID TO FRENCH OR EUROPEAN DIRECTION AND PRODUCTION STAFF

Including related social media contributions.

Production crew members responsible for:

- Artistic direction, development, and writing direction.

- Direction and administrative, technical, and accounting production management.

- Direction preparation and assistance.

- Technique and artistic quality of shots.

- Technique and artistic quality of soundtrack recordings, -set design and construction.

- Artistic design of costumes, wigs, and clothing accessories, -Creation of costumes and accessories.

- Dressing and care for costumes.

- Actors’ makeup.

- Creation of wigs and hairpieces, as well as hairstyling, -Props for the set.

- Preparation and creation of special effects, including stunts.

Production workers responsible for:

- Machinery.

- Lighting.

- Set construction.

Team members in charge of:

- Rigging and animation set up.

- Storyboarding.

- Character conception and modeling, -Set conception and modeling, -Exposure sheets,

- Pre-visualization.

- Rotoscopy.

- Tracking.

- Motion capture.

- Lay out.

- Animation.

- Set construction.

EXPENDITURES INCURRED TO ESPECIALIZED COMPANIES FOR TECHNICAL GOOD OR SERVICES

- Renting sound stages and adjoining premises.

- Renting locations specifically rented for shooting, excluding residential areas.

- Set construction on the shooting sites.

- Furniture rental (only that specifically needed for building or creating the set).

- Preparation and production of special effects, including stunts.

- Renting and creating costumes, hairstyles, and makeup.

- Equipment needed for shots, lighting, and sound pickup.

- Animation (preparation and creation).

- Equipment, supplies, computer hardware and software used directly for the animation process. The aforementioned computer software must be paid off during the production of the work for which it was designed or purchased.

- Post-production: image lab, image editing, voice recording, sound effects and sound design, mixing, sound editing, credits and trailers.

- Digital visual effects.

- Negative image film, magnetic sound film, and in general, all digital or non-digital image and sound media; filming, finishing, video, and subtitling studios.

A refund is issued by the French State to the extent the production tax credit exceeds the company’s tax liability.

The TRIP is exempt of tax and VAT exempt.

TRANSPORTATION, CATERING AND ACOMODATION EXPENDITURES

- Transport and travel of artistic and technical materials and supplies (only as strictly needed for production).

- Transport and catering for the artistic and technical teams (only as strictly needed for production; nothing lavish).

This also concerns international transport of materials as well as international travel costs of the crew and cast (in and out).

ACOMODATION EXPENDITURES

Capped at 270 € per night in greater Paris and up to 200 € per night elsewhere.

DEPRECIATION EXPENSES

Tax-deductible depreciation accruals for fixed assets held by the line production company and directly related to the production of the film or television work for which a tax rebate may be claimed. Only those depreciation expenses that correspond to the period in which the asset was actually used to produce the work eligible for the tax rebate go toward the rebate.

DEFINITIONS, ELIGIBLE COUNTRIES AND TERRITORIES

CHARACTERS

A MAIN CHARACTER

Is a character present in at least 25% of the scenes.

A SECONDARY CHARACTER

Is a character whose on screen representation requires at least 4 days of work on the final production shooting schedule and is not a main character. Note that this definition of characters allows a virtual character to score points.

FRENCH TERRITORY

France consists of the metropolitan territory and of the following:

Corsica, French Guyana, French Polynesia, Guadeloupe, Martinique, Mayotte, New Caledonia, Réunion, St. Barthélemy, Saint Martin, Saint Pierre and Miquelon, Wallis and Futuna.

EUROPEAN STATE

LIST OF COUNTRIES CONCERNED

Albania, Armenia, Austria, Azerbaijan, Belgium, Bosnia and Herzegovina, Bulgaria, Croatia, Cyprus, Czech Republic, Denmark, Estonia, Finland, France, Georgia, Germany, Greece, Hungary, Ireland, Italia, Latvia, Liechtenstein, Lithuania, Luxembourg, Macedonia, Malta, Montenegro, Netherlands, Norway, Poland, Portugal, Romania, San Marino, Serbia, Slovakia, Slovenia, Spain, Sweden, Switzerland,

Turkey, Ukraine, United-Kingdom.

FRENCH SPEAKING COUNTRIES

A French speaking country is a member of the International Organization of “La Francophonie”

LIST OF COUNTRIES CONCERNED

Albania, Andorra, Moldavia, Monaco, Algeria, Benin, Burkina Faso, Cape Verde, Côte d’Ivoire, Ghana, Guinea, Guinea Bissau, Mali, Niger, Senegal, Togo, Burundi, Cameroon, Central African Republic, Congo, Dem. Rep. of the Congo, Gabon, Equatorial Guinea, Rwanda, Sao Tome et Principe, Chad, Comoros, Djibouti, Maurice, Seychelles, Egypt, Lebanon, Morocco, Tunisia, Canada, Canada New Brunswick, Canada Quebec, Dominica, Haiti, Sainte Lucia, Cambodia, Laos, Vanuatu, Vietnam.

You want to make an official Co-Production ?

Desiring to strengthen the relationship France and India concerning film production, since 1985, both governments of the French republic and the Republic of India has agreed to the Indo-France treaty.

The official agreement between the government of the French Republic and the Government in India was signed on december, 6th, 2010.

Updated from the 1985\'s version:

Co-production Agreement between France and India in 1985